Image: Atomwise CEO and co-founder Abraham Heifets

Heart failure: charting the clinical trial landscape in the past decade

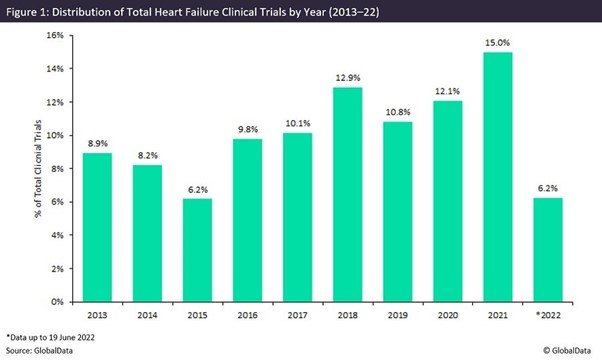

There has been an overall increasing trend in the number of clinical trial initiations for heart failure studies since 2013.

Dr Judith M. Sills. Credit: Arriello

Dr Eric Caugant. Credit: Arriello

With people living longer, the pharmaceutical sector is increasingly monitoring the healthcare burden of age-related diseases. Heart failure is one of the leading causes of hospitalisation in the ageing population and in this analysis, we examine how the clinical trial landscape for heart failure has evolved in the past decade.

Since 2013, there has been an overall increasing trend in the number of clinical trial initiations for heart failure studies. The pattern of growth does not, however, follow a consecutive trend, with a decrease in the number of trial initiations observed in 2014, 2015 and 2019, as shown in Figure 1. Despite this, the research space has experienced consecutive years of growth since 2019, with a significant increase in trial initiations last year.

The rise in initiations during the Covid-19 pandemic reveals it did not negatively impact the research landscape for heart failure. The indication remains a leading priority for researchers and healthcare providers as it is a life-threatening issue. In many cases, heart failure was investigated simultaneously with Covid-19 research.

In terms of the geographical distribution of trials, Japan led the research space in 2013 but was then overtaken by the US, which led from 2014–2017, until a surge of research in China pushed the country to top the list every year from 2018–2021. As of this month, the US has reclaimed its title as leader in heart failure research initiations by a narrow lead.

Phase distribution since 2013 shows that Phase II trials (31.8%) narrowly outnumber Phase I studies (30.6%), with Phase IV studies following close behind at 24.9% and Phase III trials at 12.7%. The relatively high proportion of Phase IV studies reveals the heart failure market is advanced, with many products already in the market, which is also dominated by generic products. But as of 2018 and coinciding with the surge of studies in China, Phase I trials have strongly led the research landscape each year. This demonstrates China’s investment in new products in a research space that has stagnated in recent years due to the availability and dominance of generic therapeutics.

From 2013–2018, institution-led heart failure studies dominated the research space, staging 62.9% of studies. There has been a significant shift in the pattern of sponsorship from 2019 onwards, with an almost equal number of studies initiated by company sponsors and institutional sponsors at 48.3% to 50.6%, respectively, with governmental and investigator-initiated trials accounting for the remainder. In a market dominated by generics, an increased level of company sponsorship may allow for innovation and lead to the production of new therapeutics. That said, if substantial improvements to generic agents are not observed in the next few years, we can expect the level of company sponsorship within this advanced market to significantly decrease.

CLINICAL TRIALS