companies achieve net zero emissions by cutting greenhouse gas (GHG) emissions to as close to zero as possible, with any remaining emissions then “offset.”

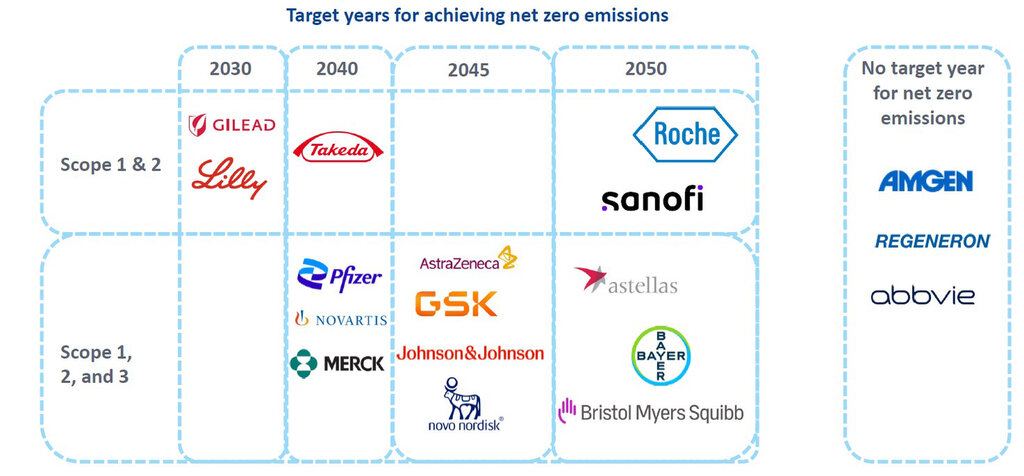

All 18 pharmaceutical companies analysed by GlobalData have committed to a target for reducing emissions or achieving net zero emissions: AbbVie, Amgen, Astellas, AstraZeneca, Bayer, Bristol Myers Squibb, Gilead Sciences, GSK, Johnson & Johnson, Eli Lilly, Merck, Novartis, Novo Nordisk, Pfizer, Regeneron, Roche, Sanofi, and Takeda.

The reporting of emissions by these pharmaceutical companies is generally of a high quality. All companies have reported Scope 1 and 2 emissions, the emissions generated by their own business operations and electricity use, since 2019. Scope 3 emissions, which are the emissions from a company’s value chain, are currently reported by 17 of the 18 companies.

Most pharmaceutical companies have started reducing Scope 1 and 2 emissions. This has typically been achieved by using electricity from renewable sources, including increased amounts of on-site power generation such as solar panels. Most companies have targets for 100% renewable energy use and all-electric vehicle fleets.

On average, 90% of a pharmaceutical company’s emissions are Scope 3 emissions. Companies can only change their Scope 3 emissions by changing or influencing suppliers or by creating products that generate less emissions when used. This impacts relationships with suppliers.

Pharmaceutical companies are setting targets for suppliers to adopt emissions targets. Leading players are also joining industry groups such as Energize and Activate that aim to help suppliers reduce their emissions. Those companies in the pharmaceutical supply chain that can set emissions targets and start working toward net zero will likely stand a better chance at securing long-term business partnerships.

Who is winning the race to net zero?

All companies analysed by GlobalData have set shorter-term targets for reducing emissions and most have set a target year for achieving net zero emissions.

Source: GlobalData; Company data

GlobalData has analyzed the targets, emissions data, and net zero strategies of 20 leading consumer companies. These companies have generally provided granular emissions data and had detailed net-zero strategies. The leaders below were selected based on the level of implementation of their strategy.

All companies we looked at have ambitious net zero strategies, but the following have made the most notable progress:

AstraZeneca is developing an inhaler that does not rely on greenhouse gases as a propellant, which will significantly reduce part of its value chain emissions. It also has one of the most ambitious supplier targets of the companies analysed, aiming for 95% of suppliers to have science-based emissions reduction targets by 2025.

Pfizer is conducting life cycle assessments for drugs, vaccines, and devices. Such assessments are key to reducing Scope 3 emissions over the long-term. It is part of industry groups like Energize and Activate, which aim to help suppliers decarbonize, and has adopted some of the most ambitious targets for reducing value chain emissions.

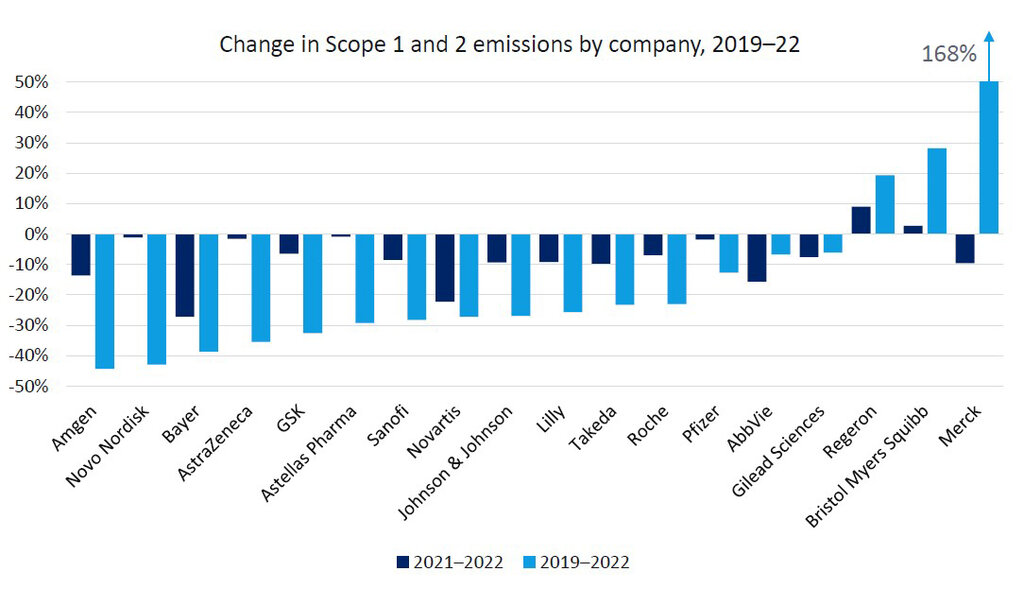

Amgen reduced operational emissions between 2019 and 2022 by 44%, leading the 18 companies included in this report. It has one of the earliest emissions targets for reducing Scope 1 and 2 emissions, with a target set for 2027.

Takeda achieved its 2025 emissions target early after aiming to cut Scope 1 and 2 emissions by 40% by 2025 from a 2016 baseline. It wants 67% of suppliers to have science-based emissions reduction targets by 2024.

Key net-zero strategies for pharmaceutical companies

Net zero strategies focus on renewables, product lifecycles, and suppliers. Supplier engagement is the key challenge for the pharmaceutical industry’s net zero targets.

Energy efficiency and renewables:

- Pharmaceutical companies are switching to renewables, and many have targets for 100% renewable energy by 2030 or earlier.

- Renewable energy targets are being achieved through purchases and installation of on-site renewables like solar.

- Vehicle fleet electrification is also a common strategy for cutting Scope 1 and 2 emissions.

Green chemistry and product lifecycles

- Companies are scrutinizing the chemicals they use and laboratory processes to cut emissions.

- Some companies are trying to cut their use of fluorinated gases (F-gases), which have a high global warming potential. F-gases are used in refrigeration and as a propellant in inhalers.

Supplier engagement

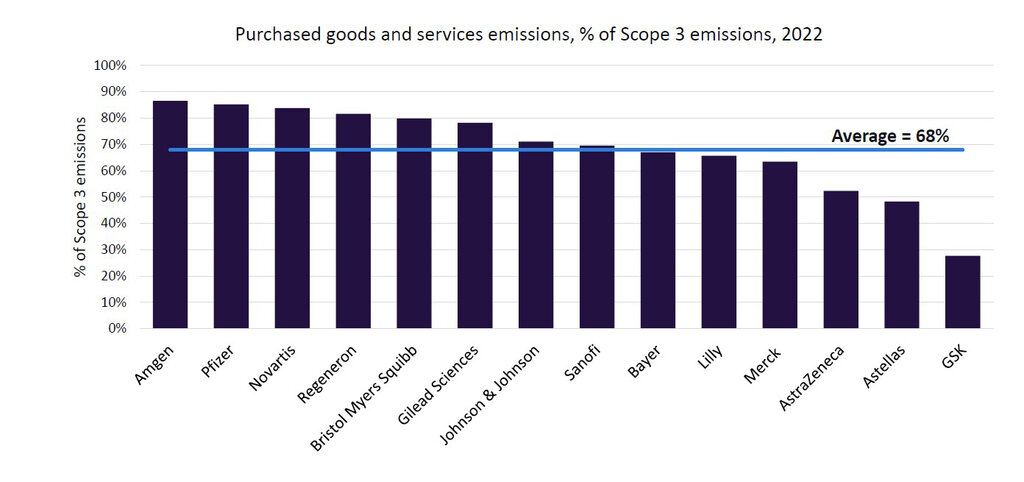

- Purchased goods and services are the largest contributor to pharmaceutical companies' emissions.

- Companies are urging their suppliers to set emissions targets. Industry groups have been established to help pharmaceutical suppliers use more renewable energy and reduce emissions from active pharmaceutical ingredients.

Scope 1 and 2 emission reduction strategies

Scope 1 and 2 emissions are known as operational emissions. They are the emissions generated by a company’s operations, as opposed to its value chain. These are the easiest emissions for businesses to measure and reduce because they are generated by assets a company owns and controls or are just from electricity use.

Pharmaceutical companies are focused on reducing emissions in stores, distribution centers, warehouses, and offices. Switching to renewable sources of electricity is typically one of the first things a company will do to reduce its emissions. This reduces Scope 2 emissions, and the companies with the lowest ratio of Scope 2 to Scope 1 emissions will be the companies that are sourcing the most power from renewable sources.

Vehicle fleets are key sources of Scope 1 emissions. Electrifying vehicle fleets and sourcing electricity from renewable sources are key components of pharmaceutical companies’ net zero strategies.

Source: GlobalData; Company data

Most pharmaceutical companies have started reducing Scope 1 and 2 emissions. The combined emissions of the 18 selected pharmaceutical companies have fallen every year since 2019. Most companies have reduced their emissions over the last three years. Merck’s emissions rose sharply from 2019 to 2022 due to its takeover of Versum, a supplier of specialist materials to the semiconductor industry.

Intensive Scope 3 emissions: pharma's strategic focus for net zero

Scope 3 emissions account for an average of 90% of the emissions for the 18 companies analyzed by GlobalData. Most Scope 3 emissions are from purchased goods and services, meaning pharma companies will put suppliers under increasing pressure to cut emissions.

Many pharmaceutical companies have set targets that will impact their suppliers. The most common target relating to supplier emissions was commitments to have a certain percentage of suppliers set emissions reduction targets. Large pharmaceutical companies can have tens of thousands of suppliers.

Another key source of Scope 3 emissions for every company with available data was upstream transportation and distribution. Many companies are aiming to shift from air to sea shipment.

Source: GlobalData; Company data

Companies are constantly refining and developing their methods for calculating Scope 3 emissions. Calculating Scope 3 emissions often depends heavily on estimation and is not yet at the stage across any sector where companies can be reliably compared.

Companies tend to recalculate previous years’ data when updating their Scope 3 calculation method. This means Scope 3 data is often a reliable indicator of how a company's value chain emissions are changing over time.

By reporting Scope 3 emissions, companies can assess the risks of policies like emissions pricing, carbon taxes, and other environmental regulations on their value chains.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.