Corporate interest in environmental, social, and governance (ESG) issues began to gain momentum in the years following the 2015 adoption of the Paris Agreement, an international treaty on climate change mitigation, adaptation, and finance. The agreement was signed by 196 nations—including major greenhouse gas (GHG) emitters the US and China—that all committed to keeping global warming well below the agreed limit of 2°C above pre-industrial temperatures.

It marked the beginning of ESG 1.0, in which companies began to come under increasing pressure to consider the ethical impact and sustainability of their operations. This went beyond emissions, extending to companies’ broader environmental practices, social responsibility, and corporate governance.

In response to this pressure, and identifying a marketing opportunity, companies began to set targets for slashing emissions and publish ESG disclosures following voluntary guidelines such as the Global Reporting Initiative (GRI). ESG ratings, which provide investors with a way to gauge the robustness of company ESG commitments and credentials, became mainstream and the number of providers increased.

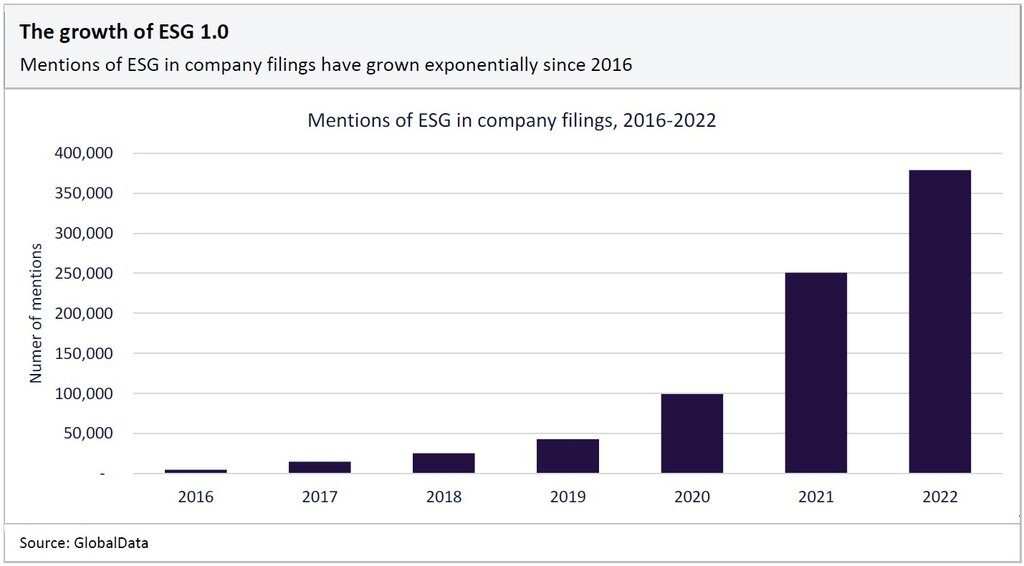

Data from GlobalData’s Company Filings Analytics Database, which tracks the filings of around 15,000 companies worldwide, shows that mentions of ESG in company filings increased exponentially over the following six years.

Much of the initial momentum behind ESG 1.0 came from the financial sector. The world’s largest asset managers, pension funds, and sovereign wealth funds joined initiatives such as the UN Principles for Responsible Investment (UN PRI), committing themselves to engage with their portfolio companies on ESG issues.

ESG began to take on new importance in 2021 when Engine No.1, a relatively unknown hedge fund, won a shareholder voting campaign against Exxon, forcing the oil giant to appoint three directors more capable of handling the global transition away from fossil fuels. It was a sign that stakeholders were becoming less forgiving of sub-par ESG strategies.

Exxon’s defeat was accompanied in the same year by the first stages of the EU’s regulatory push on ESG; its Green Taxonomy and Sustainable Finance Disclosure Requirements (SFDR). This regulation controlled which investment funds could be labeled as sustainable.

Then followed a tumultuous 2022. Russia invaded Ukraine, sending gas prices to record highs. The asset management arms of Goldman Sachs and BNY Mellon received fines for greenwashing—where sellers overstate the green credentials of a product or service - while the chief executive of German asset manager DWS resigned after its offices were raided over greenwashing accusations.

ESG then ran into political pushback in the US. Several US-based financial institutions including BlackRock, the world’s largest asset manager, had started factoring ESG considerations into their investment decisions.

BlackRock’s chief executive Larry Fink also urged portfolio companies to set targets for reducing emissions and produce reports showing how they were managing climate risks. In response, a coalition of 19 US states wrote to BlackRock in August 2022 arguing that it was putting politics above financial returns. The states were concerned that this would lead to lower returns on their public sector workers’ pension savings.

ESG was also becoming a partisan political issue following the passing of President Biden’s Inflation Reduction Act in the same month. It did not end there. Before the month was over, 21 Republicans from the US House of Representatives wrote to the US Securities and Exchange Commission (SEC), requesting it rescinds its planned rules to make listed companies produce mandatory reports on their emissions.

Companies now have to be careful about their communications and strategy on ESG. Regulators are increasingly keen to scrutinize them, politicians might single them out, and stakeholders are demanding action to meet ESG commitments. These are some of the hallmarks of the second phase of ESG.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.