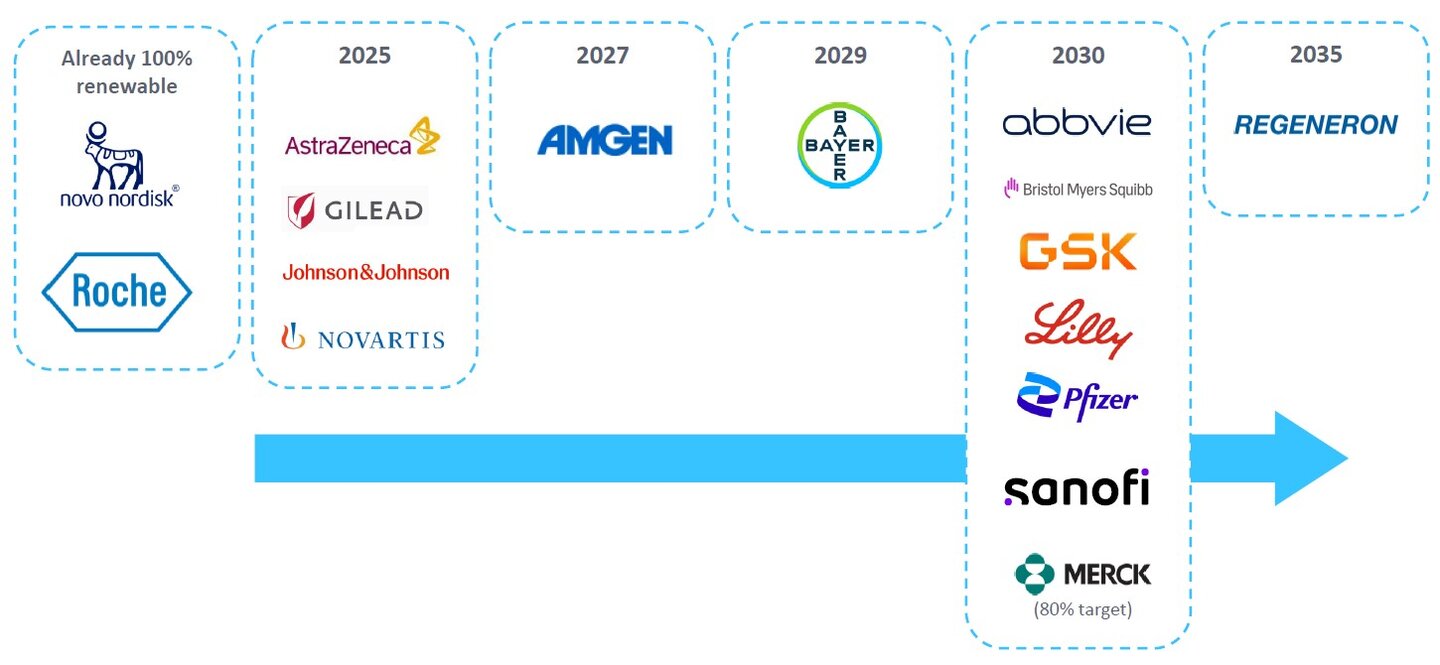

Many pharma companies have adopted targets for 100% renewable energy usage. Novo Nordisk and Roche are leading the way, already using 100% renewable electricity.

The renewable energy usage targets of leading pharma companies. Source: GlobalData, company data

Here we look at notable examples and initiatives in the pharma industry’s path towards net zero.

Companies are using on-site solar to help meet renewable energy targets

Going into 2022, four solar installations at Gilead’s owned facilities had the capacity to generate up to 9.5 million kWh per year. In 2022, Gilead installed an additional solar array at its manufacturing facility in Cork, Ireland. The new installation can generate 584 MWh of electricity annually and avoid 248 metric tonnes of greenhouse gas emissions.

In 2022, Eli Lilly installed a 20,000-square-meter parking canopy solar array in Fegersheim, France. The array allows the manufacturing site to directly produce about 12% of its electrical energy needs.

Cross-industry initiatives

Companies are using cross-industry initiatives to decarbonize supply chains. Activate and Energize are two such initiatives with support from major pharmaceutical companies.

AstraZeneca, Bristol Myers Squibb, GSK, Johnson & Johnson, Pfizer, and Sanofi launched Activate, a cross-industry initiative to reduce emissions from active pharmaceutical ingredients (API), at the COP27 climate conference in 2022. The initiative aims to help suppliers by supporting green chemistry solutions, making financing available for decarbonization projects, training and development for target setting, development of API best practices, and access to renewable technologies.

Energize is a collaboration between Schneider Electric, a power company, and 10 pharmaceutical companies: AstraZeneca, Biogen, GSK, Johnson & Johnson, MSD, Novartis, Novo Nordisk, Pfizer, Sanofi, and Takeda. The initiative will allow suppliers to participate in the market for power purchase agreements, which are agreements to purchase clean energy from a power supplier at a predetermined price.

AstraZeneca and Honeywell target inhaler emissions

AstraZeneca’s inhalers currently rely on fluorinated gases (F-gases) as a propellant. F-gases have a high global warming potential, 26,000 times more than the equivalent mass of CO2, according to the UK Climate Change Committee.

17% of AstraZeneca’s Scope 3 emissions are from the use of sold products, most of which is due to its inhalers. F-gases also contribute to emissions from the end-of-life treatment of sold products and AstraZeneca’s Scope 1 emissions. Finding a substitute for F-gases is key to AstraZeneca’s strategy to cut its Scope 3 emissions.

In 2022, AstraZeneca announced it was partnering with Honeywell to develop a near-zero global warming potential propellant that would help it achieve its net zero goals. Honeywell’s propellant is known as Solstice Air (HFO-1234ze) and is also used as a low GWP substitute for refrigerants in chillers and commercial air conditioning. The partnership hopes to bring the product to market by 2025.

Green chemistry and product lifecycles

Sanofi has said that by 2025, all new products it brings to market will be eco-designed, which is where environmental criteria are embedded into a product’s entire lifecycle, not just its initial design and manufacture. This will be extended to the main products already commercialized by Sanofi by 2030. By 2027, it also plans to end the use of plastic in blister packs for all vaccine syringes.

Merck is switching to bio-based solvents and has developed its own bio-based solvent, Cyrene. Merck is a member of the EU Horizon 2020 project ReSolute, which started the construction of a new Cyrene facility in 2021 to meet the growing demand for greener solvents.

In 2022, Merck expanded its selection of bio-based laboratory chemicals included in the US Department of Agriculture's BioPreferred program. These chemicals are certified to be derived from plants and renewable sources rather than conventional petroleum-derived products.

Bristol Myers Squibb partnered with protein engineering firm Codexis to evolve two enzymes to enable the manufacture of a key intermediate en route to its LPA agonist BMS-986278, an active pharmaceutical ingredient within its immunology portfolio.

This innovation led to reductions in waste and cost and eliminated the use of hazardous halogenated solvents. This work was recognized by the 2023 American Chemical Society Green Chemistry Institute Peter J. Dunn Award for Green Chemistry & Engineering.

Pfizer is conducting representative life cycle assessments for small molecules, large molecules, vaccines, and devices. The output of these assessments will be used to identify areas of focus in development and manufacturing processes. This will help Pfizer take preventative actions to reduce the environmental impact of products and manufacturing, with particular emphasis on GHG emissions reductions.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.