Image: Atomwise CEO and co-founder Abraham Heifets

EU biosimilar wave slows as biosimilar approvals decrease in the EU

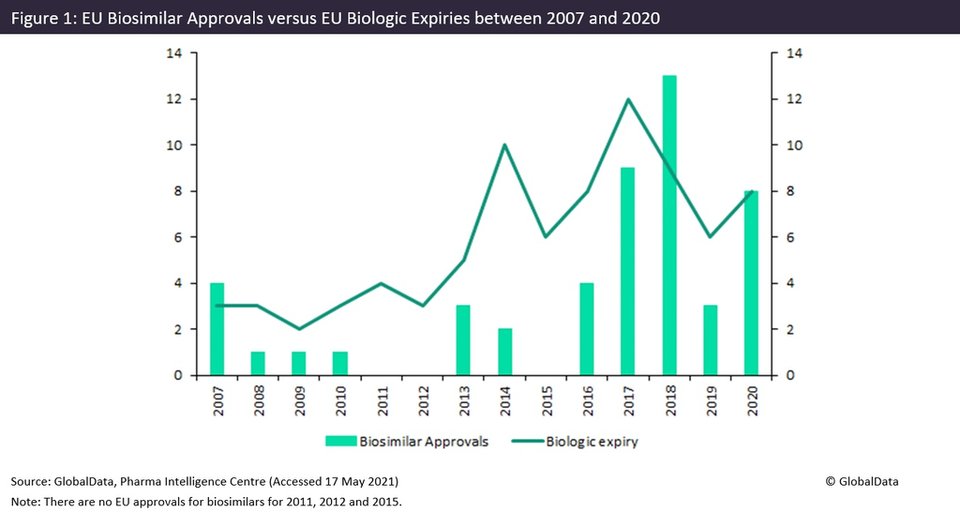

The EU biosimilar approval wave appears to have peaked in 2018 and is now experiencing a decline, which is expected to continue.

Dr Judith M. Sills. Credit: Arriello

Dr Eric Caugant. Credit: Arriello

According to the ‘Biosimilar Waves – Future of Biosimilar Approvals and Development’ presentation at CPhI North America on 5 August, biosimilar approvals come in waves of approvals in different regions, which peak and then subsequently drop.

A biosimilar drug is a biological drug that is approved based on its showing that it is highly similar to an approved innovator biologic, known as a reference drug.

The European Union’s (EU) biosimilar wave appears to have peaked with the most approvals in 2018 and is now experiencing a decrease in the number of approvals between 2019-2020, which is expected to continue.

Biosimilars come in waves of development and approval, with large surges of biosimilars in late-stage pipeline development alongside increases in approvals of biosimilar products.

These biosimilar waves often coincide with the expiry of innovator biologics, as the loss of market exclusivity within a region provides biosimilar developers with a greater opportunity to enter a market and removes legal and patent barriers to their entry.

The EU was the first region globally to experience a biosimilar wave between 2006 and last year. According to the presentation at CPhI North America, the US is currently amidst its own wave of biosimilar approvals, with the Asia-Pacific region next in line to experience a biosimilar wave according to recent data.

The EU biosimilar wave shows an average increase of 69% in approvals between 2013 and 2018, with peak approvals of 13 biosimilars in 2018. This corresponds with the 2017 peak in innovator biologic expiries, with 12 drugs expiring. The EU biosimilar wave subsequently slowed down with a decline in biosimilar approvals in 2019 and last year.

The reason the EU region experienced this biosimilar wave ahead of other regions such as the US or Asia-Pacific is due to the EU creating the first biosimilar-specific approval pathway in 2005 and subsequently approving the first biosimilar somatropin in 2006.

In addition, the acceptance of using biosimilars over brand biologics within the EU allowed the EU to have strong uptake of biosimilars, resulting in the EU as the largest market for biosimilars over the last 15 years.

Biosimilars have long been an opportunity to cut healthcare costs, as the cost of developing a biosimilar, while more than a generic, will still be less than developing an innovator biologic, meaning they can be sold for up to 30% less than their reference biologics.

Plus, as healthcare costs continue to increase worldwide, other regions, including the US and Asia-Pacific, are beginning to focus on developing biosimilars, hoping to lessen their healthcare burdens.

Going into the future, we can anticipate that EU biosimilar approvals will continue to fall from their peak in 2018 as this wave moves down from its peak.

Biosimilar development and approvals are set to follow similar waves in other regions, including the US and Asia-Pacific, with more details included in the ‘Biosimilar Waves – Future of Biosimilar Approvals and Development’ presentation.

For pharmaceutical industry data, comment and analysis, visit GlobalData's Pharmaceuticals Intelligence Centre.

Comment from