DEALS ANALYSIS

Deals activity: Positive growth in oncology sector; YoY volume drops in all regions

Powered by

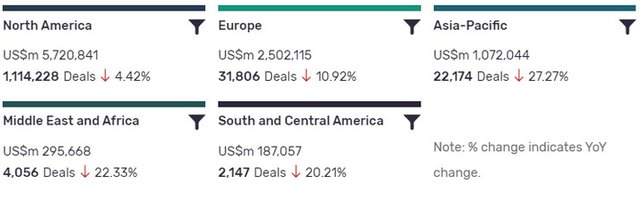

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded a YoY decline in deals volume at -4.42%. South and Central America, ranking last in terms of deal value, has also seen notable YoY change, with deal volumes decreasing by -20.21%.

The volume of deals recorded by GlobalData also decreased YoY in Asia-Pacific (-27.27%), Europe (-10.92%) and Middle East and Africa (-22.33%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 483,004 | 18,539 | -13.30 |

| Venture Financing | 255,408 | 19,114 | 121.09 |

| Contract Service Agreement | 1,860 | 19,125 | -49.18 |

| Equity Offering | 970,637 | 16,971 | 68.39 |

| Licensing Agreement | 743,425 | 13,928 | 54.43 |

| Grant | 393,786 | 1,041,900 | 10.58 |

| Acquisition | 3,754,139 | 11,069 | 16.52 |

| Debt Offering | 1,793,837 | 7,948 | -9.48 |

| Asset Transaction | 437,921 | 6,136 | -39.04 |

| Private Equity | 510,223 | 2,637 | 48.47 |

| Merger | 177,353 | 709 | 848.02 |

A breakdown of deals by type and volume shows an 848.02% growth in mergers YoY, while acquisitions are up 16.52%, partnerships declined with -13.30% change YoY and asset transactions are down -39.04%. Financing deals have increased across some types, with venture financing up 121.09% YoY, equity offerings up 68.39%, but debt offerings down -9.48%.

Private equity has seen 48.47% growth in number of deals YoY, while the number of grants recorded is up 10.58%. The number of contract service agreements recorded by GlobalData has declined -49.18% YoY.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of oncology. After recording 3,193 deals in 2020, the sector has witnessed 1,249 deals in H1 2021.

Note: All numbers as of 16 June 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

HiFiBiO raises series D funds to advance immuno-oncology candidates

HiFiBiO Therapeutics has raised $75m in a Series D funding round, led by Mirae Asset Financial Group, to expedite its pipeline with two immuno-oncology programmes. The financing round was joined by other new investors B Capital Group, Sherpa, Maison Capital, Trinity Innovation Fund, Grand Mount and HKSTP Venture Fund.

Indivior and Aelis enter $130m deal for cannabis addiction therapy

Indivior has entered a strategic partnership and an exclusive option and licence agreement with France-based Aelis Farma for worldwide rights to the latter’s lead compound, AEF0117. AEF0117 is a synthetic signaling specific inhibitor designed to hinder the cannabinoid type 1 receptor. It could become the first therapy for cannabis-related disorders, the company noted.

Dermavant raises $200m to support tapinarof launch

Dermavant Sciences has signed a $160m revenue interest purchase and sale agreement for tapinarof with Marathon Asset Management, NovaQuest Capital Management and a third unnamed institutional investor in the US. A Roivant Sciences subsidiary, Dermavant focuses on developing and marketing treatments in immuno-dermatology areas with unmet medical needs.

Merck completes spinoff of women’s health company Organon

Merck has completed the spinoff of Organon to boost its focus on growth areas, realise higher revenue and earnings per share growth rates. Merck obtained a distribution of nearly $9bn from Organon as part of the spinoff. As a separate company, Organon will now focus on enhancing women’s health and currently has a portfolio of approximately 60 treatments and products.

MorphoSys to acquire Constellation Pharmaceuticals for $1.7bn

MorphoSys has signed a definitive agreement to acquire Constellation Pharmaceuticals for a total equity value of $1.7bn or $34 per share, in cash. Constellation’s lead product candidates, pelabresib (CPI-0610), a BET inhibitor, and CPI-0209, an EZH2 inhibitor, are currently in mid to late-stage clinical trials.

Nordic Capital acquires Advanz Pharma for $846m

Nordic Capital subsidiary Cidron Aida Bidco has acquired all issued and to-be-issued limited voting share capital of UK-based speciality pharmaceutical company, Advanz Pharma, for a total value of nearly $846m. According to the deal, each Advanz Pharma shareholder will get $17.26 in cash per share of the company.