DEALS ANALYSIS

Deals activity: North America extends deals value lead; mergers pull ahead YoY

Powered by

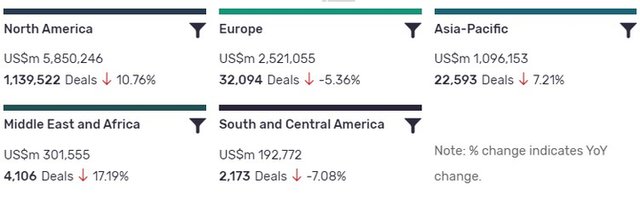

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded YoY decline in deals volume at -10.76%. South and Central America, ranking last in terms of deal value, has also seen notable YoY change, with deal volumes decreasing by -7.08%.

The volume of deals recorded by GlobalData also decreased YoY in Asia-Pacific (-7.21%), Europe (-5.36%) and Middle East and Africa (-17.19%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 499,515 | 18,761 | -32.20 |

| Venture Financing | 264,184 | 19,503 | 103.39 |

| Contract Service Agreement | 1,860 | 19,215 | -48.77 |

| Equity Offering | 991,774 | 17,209 | 27.70 |

| Licensing Agreement | 767,919 | 14,135 | 11.96 |

| Grant | 404,436 | 1,066,478 | 15.95 |

| Acquisition | 3,772,244 | 11,157 | 28.34 |

| Debt Offering | 1,800,770 | 7,978 | -53.49 |

| Asset Transaction | 440,712 | 6,172 | -42.60 |

| Private Equity | 572,387 | 2,704 | 301.62 |

| Merger | 177,802 | 728 | 489.37 |

A breakdown of deals by type and volume shows a 489.37% growth in mergers YoY, while acquisitions are up 28.34%, however, partnerships decreased with -32.20% change YoY and asset transactions declined -42.60%. Financing deals have increased across some types, with venture financing up 103.39% YoY, equity offerings up 103.39%, but debt offerings deals are down -53.49%.

Private equity has seen 301.62% growth in number of deals YoY, while the number of grants recorded is up 15.95%. The number of contract service agreements recorded by GlobalData has declined -48.77% YoY.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of infectious diseases. After recording 2,424 deals in 2020, the sector has witnessed 1,003 deals to date in 2021.

Note: All numbers as of 17 August 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

Exelixis and Invenra expand partnership to develop cancer antibodies

Exelixis and Invenra have extended their discovery and licensing partnership to include 20 more oncology targets for multi-specific antibodies, antibody-drug conjugates, and the development of other biologic candidates. In May 2018, the companies collaborated to discover and develop mono-specific and multi-specific antibodies for integration into new biologic therapies to treat cancer.

HDT Bio and Quratis to jointly develop Covid-19 vaccine in Asia

HDT Bio has signed an agreement with Korean biotech Quratis to jointly develop its messenger ribonucleic acid (mRNA) Covid-19 vaccine for supply in South Korea and neighbouring markets. The vaccine utilises HDT Bio’s lipid inorganic nanoparticle formulation to carry immune-stimulating RNA fragments to targeted cells.

GentiBio raises $157m to develop Treg therapies for autoimmune diseases

GentiBio has raised $157m in a Series A funding round led by Matrix Capital Management to progress its new pipeline of engineered regulatory T cell (Treg) treatments in immunology. Avidity Partners, JDRF T1D Fund, OrbiMed, RA Capital Management, Novartis Venture Fund and Seattle Children’s Research Institute participated in the financing round.

EQRx signs $1.8bn merger deal with CM Life Sciences III

Pharmaceutical company EQRx and a life science-focused special purpose acquisition company, CM Life Sciences III, have signed a definitive business combination agreement worth up to $1.8bn. CM Life Sciences III is sponsored by Casdin Capital and Corvex Management affiliates.