Immuno-oncology high prescriber survey reveals which R&D strategies the industry should be focusing on in the 7MM

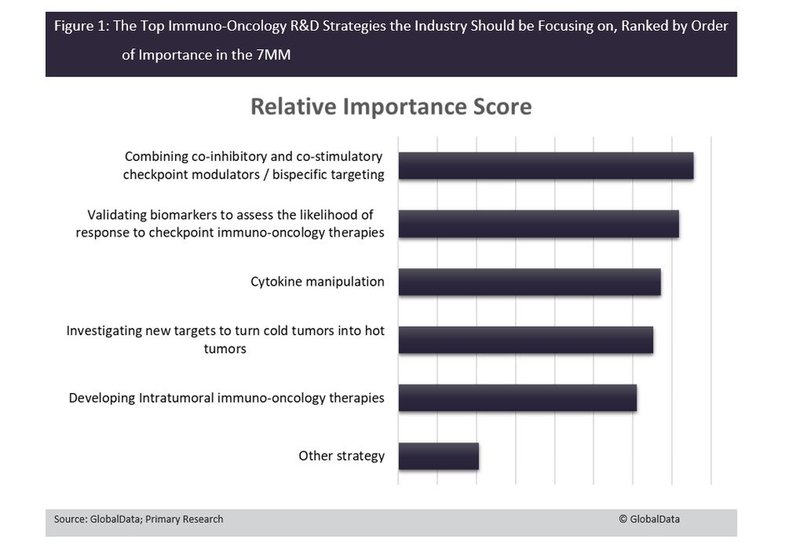

High-prescribing physicians who routinely use immuno-oncology (IO) agents in their practice ranked the combination of co-inhibitory and co-stimulatory checkpoint modulation as the most important R&D strategy that the industry should be working on in the seven major markets (7MM): the US, France, Germany, Spain, Italy, UK and Japan (Figure 1).

Other very important R&D strategies include validating biomarkers to guide personalised IO therapy based on the likelihood of response and cytokine manipulation as supportive augmentation of other IO therapies.

Finding a balance between inhibition and strong stimulation of immune signalling is viewed as a great challenge while providing an important drug development opportunity.

For example, single-agent PD-1/PD-L1 checkpoint inhibition is often inadequate and combinations with co-stimulation of other checkpoints to promote further anti-tumour immunity would be highly desirable.

Bispecific antibodies are viewed as ideal to achieve this, as one antibody can engage in suppressing or augmenting controllers of immune activity simultaneously.

The aforementioned balance is key because while a strong anti-tumour response has apparent therapeutic advantages, it also carries a number of very significant side effects.

The intensity of these side effects may increase proportionally to the anti-tumour immune response and it should be reduced for this approach to translate in the clinic.

T-cell redirection is another version of the same strategy, wherein a bispecific antibody may target a tumour antigen while stimulating further immunity by bringing more T-cells into the tumour microenvironment.

Notable examples of this strategy include the late-stage anti-CD20/CD3 antibodies, Roche’s mosunetuzumab and Genmab’s epcoritamab for non-Hodgkin’s lymphoma.

The discovery of new biomarkers that limit IO therapy only to the most likely responders has been a hurdle for this field since the initial success of checkpoint inhibition in melanoma and limited success has only come about with the use of PD-L1 expression levels or measures of mutational burden/potential such as microsatellite instability.

As such, this is simultaneously an unmet need and an important strategy that physicians think should occupy much of the industry’s focus. Cytokine manipulation such as with interleukins or interferons has mostly fallen out of favour with physicians and key opinion leaders (KOLs) due to better options being available.

However, physicians believe that very interesting and promising biology for cytokine manipulation remains and that it just requires groundbreaking approaches to rejuvenate the field.

Recently, Nektar Therapeutics’ bempegaldesleukin has generated significant KOL excitement for its potential in melanoma when combined with Bristol Myers Squibb’s Opdivo, leading to high future sales projections by analysts.

Several variations of other R&D strategies were echoed by physicians at a lower frequency such as the need for head-to-head comparisons to pick the best among the drugs that are already marketed, investigation of the potential of time-limited therapy to alleviate long-term toxicities and the potential for sequential treatment wherein various mechanisms of action are introduced at different times.

For pharmaceutical industry data, comment and analysis, visit GlobalData's Pharmaceuticals Intelligence Centre.

Market Insight from