DEALS ANALYSIS

Deals activity: Venture financing deals on the rise; YoY deals decline in all regions

Powered by

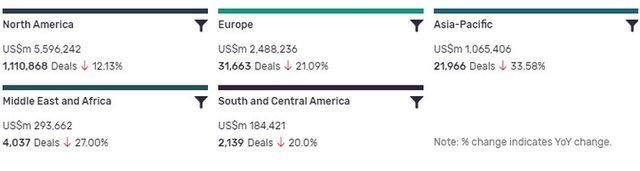

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded YoY decline in deals volume at 12.13%. South and Central America, ranking last in terms of deal value, has also seen notable YoY change, with deal volumes decreasing by 20%.

The volume of deals recorded by GlobalData also decreased YoY in Asia-Pacific (33.58%), Europe (21.09%) and Middle East and Africa (27%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 479,145 | 18,422 | 5.23 |

| Venture Financing | 250,013 | 18,835 | 131.45 |

| Contract Service Agreement | 1,860 | 19,080 | 69.44 |

| Equity Offering | 954,851 | 16,823 | 135.86 |

| Licensing Agreement | 735,777 | 13,856 | 59.06 |

| Grant | 302,203 | 1,038,967 | 16.51 |

| Acquisition | 3,749,163 | 10,992 | 6.85 |

| Debt Offering | 1,781,028 | 7,920 | -5.47 |

| Asset Transaction | 435,466 | 6,127 | -36.65 |

| Private Equity | 514,049 | 2,614 | 98.57 |

| Merger | 173,760 | 705 | 616.30 |

A breakdown of deals by type and volume shows a 616.30% growth in mergers YoY, while acquisitions are up 6.85%, partnerships grew with 5.23% change YoY and asset transactions are down -36.65%. Financing deals have increased across some types, with venture financing up 131.45% YoY, equity offerings up 135.86% and debt offerings are down -5.47%.

Private equity has seen 98.57% growth in number of deals YoY, while the number of grants recorded is up 16.51%. The number of contract service agreements recorded by GlobalData is up 69.44% YoY.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of oncology. After remaining relatively steady over the past ten years, the number of recorded deals in oncology increased significantly in 2020/21.

Note: All numbers as of 19 May 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

Charles River to acquire CDMO Vigene Biosciences for $292.5m

Charles River Laboratories International has entered a definitive agreement to acquire gene therapy contract development and manufacturing organisation (CDMO) Vigene Biosciences for approximately $292.5m in cash. According to the terms of the deal, Vigene Biosciences is also eligible to get performance-based future payments of up to $57.5m.

Natco Pharma and Lilly sign licencing deal for baricitinib use in India

Indian company Natco Pharma has entered a royalty-free, non-exclusive, voluntary licensing agreement with Eli Lilly to produce and market the latter’s drug, baricitinib, as a Covid-19 treatment in the country.

CD&R to acquire UDG Healthcare for $3.7bn

Private equity firm Clayton, Dubilier & Rice (CD&R) has agreed to acquire Ireland-based UDG Healthcare for a total of $3.7bn (£2.6bn) in cash. According to the deal, UDG will receive $14.39 (£10.23) per share from CD&R.

Lilly and MiNA Therapeutics enter deal to develop saRNA-based drugs

Eli Lilly and MiNA Therapeutics have entered a global research partnership to develop new drug candidates using the latter’s small activating RNA (saRNA) technology platform. The partnership will leverage MiNA’s saRNA platform to explore up to five targets chosen by Lilly to treat diseases across its key therapeutic areas.

Abingworth raises $582m to advance late-stage clinical trials

The Abingworth Clinical Co-Development Fund 2 (ACCD 2) has exceeded its target of $350m and closed at the hard cap. ACCD 2 will be used to advance late-stage clinical programmes from pharmaceutical and biotechnology companies.

Pfizer acquires Amplyx Pharmaceuticals to advance anti-infectives pipeline

Pfizer has acquired US-based Amplyx Pharmaceuticals to advance its expertise in infectious disease and expand its anti-infectives pipeline. With this deal, Pfizer gained ownership of Amplyx’s lead compound, Fosmanogepix, a new investigational asset being developed for treating invasive fungal infections.