Image: Atomwise CEO and co-founder Abraham Heifets

Entrance of novel therapies will drive Cushing’s syndrome market growth

Dr Judith M. Sills. Credit: Arriello

Dr Eric Caugant. Credit: Arriello

Cushing’s syndrome (CS) is a serious, debilitating endocrine disorder caused by prolonged exposure to excess levels of cortisol (hydrocortisone) or other glucocorticoids from endogenous or exogenous sources.

Endogenous CS is divided into two groups: those due to an excess of adrenocorticotropin hormone (ACTH), also known as ACTH-dependent, and ACTH-independent. A pituitary adenoma, also known as Cushing’s disease (CD), is the most common form of endogenous CS.

CD produces excess ACTH that stimulates the adrenal cortex to produce excess glucocorticoid hormones. Other forms of endogenous CS include ACTH-independent ectopic tumours of the adrenal gland (adrenocortical adenomas) and adrenocortical carcinomas.

Exogenous CS is principally caused by iatrogenic glucocorticoid administration, such as prednisolone administration over a long period of time.

The current treatment for CS involves the use of glucocorticoid receptor (GR) antagonists, such as Corcept’s Korlym (mifepristone), steroidogenesis inhibitors such as Recordati Rare Diseases’ Isturisa (osilodrostat), ketoconazole, HRA Pharma Rare Diseases’ Lysodren (mitotane) and Metopirone (metyrapone), and somatostatin analogue Recordati Rare Diseases’ Signifor (pasireotide)/Signifor LAR.

These therapies tend to address the overproduction of cortisol but are unable to tackle the underlying pathophysiology of CS, leaving a significant unmet need that biopharmaceutical companies have yet to fully address

Although novel therapies offer improved efficacy in comparison to the currently marketed therapies, the improvement is not considered significant

There are several late-stage pipeline therapies for CS across the two major markets (2MM), namely the US and Germany, with a high likelihood of approval. Key opinion leaders (KOLs) interviewed by GlobalData have expressed enthusiasm over this development.

These therapies are the novel GR-II antagonist Corcept Therapeutics’ relacorilant (Phase III in the EU and US), Strongbridge Biopharma’s steroidogenesis inhibitor Recorlev (levoketoconazole), pre-registration in the US and Phase III in the EU, and Sparrow Pharmaceuticals’ first-in-class hydroxysteroid dehydrogenase-1 (HSD-1) inhibitor SPI-62 (Phase II in the US).

KOLs have, however, reported that they are unimpressed with the efficacy and safety data for these therapies, as well as the primary endpoints of their trials.

Although novel therapies offer improved efficacy in comparison to the currently marketed therapies, the improvement is not considered significant, and they are expected to have less adoption over less expensive counterparts, such as ketoconazole and generic therapies set to launch during the forecast period such as mifepristone, osilodrostat phosphate (generic of Isturisa) and pasireotide (generic of Signifor).

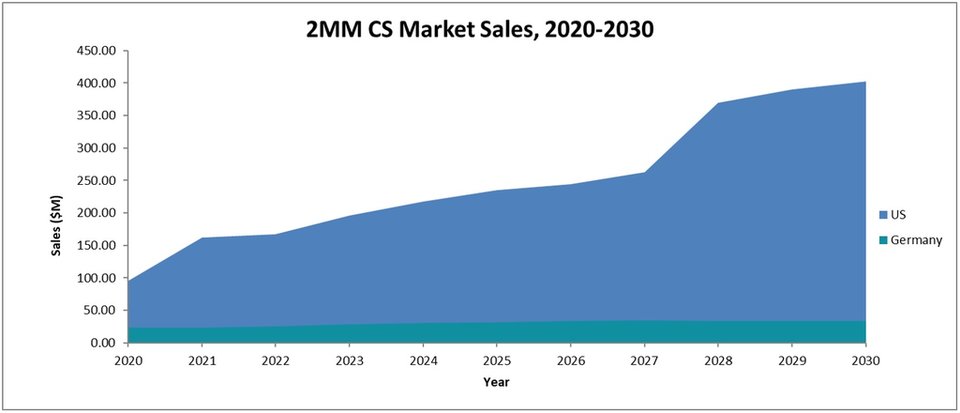

GlobalData expects that the CS market will see significant growth from last year to 2030. The 2MM will increase in market size from total sales of $121.35m last year to $448.73m in 2030, at a compound annual growth rate of 14.0%. This sales growth will be in line with a steadily increasing disease prevalence in the US market and the entrance of novel agents across the 2MM.

The figure below shows the forecast sales for the CS market.

Across the 2MM, there have been steady improvements in the treatment of CS, with significantly improving diagnosis rates due to physicians having developed a better understanding of CS symptoms.

This has led to improved accuracy in CS diagnosis for patients demonstrating early CS symptoms such as weight gain and more body fat in their upper trunk, as well as depression, bruising skin and a reddened, round face. This will increase the number of prescriptions for all three main classes of therapy, but particularly for steroidogenesis inhibitors.

Recorlev will likely launch in H2 2021 in the US, and several generics will launch across the forecast period as the patents of branded therapies Isturisa and Recorlev expire in 2026 and 2030 respectively.

In addition, if SPI-62 produces successful late-stage clinical data and gains approval from the US Food and Drug Administration, it is likely to achieve significant uptake from physicians and gain a large market share in the US CS market, with sales of around $118.3m, due to its novel mechanism of action and promising initial clinical data. KOLs expressed positive interest when questioned about SPI-62.

COMMENT from