DEALS ANALYSIS

Deals activity: North America leads by value; infectious disease deals are up

Powered by

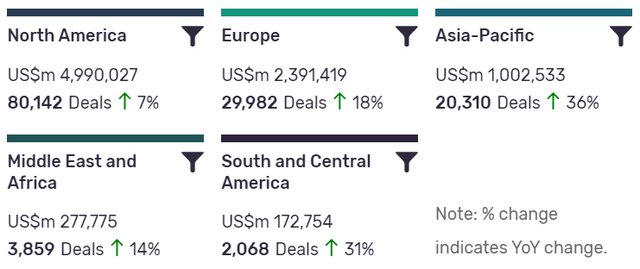

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded the lowest YoY growth in deals volume at 7%. Asia-Pacific, ranking third in terms of deal value, has seen the biggest YoY change, with deal volumes increasing by 36%.

The volume of deals recorded by GlobalData also increased year-on-year in South and Central America (31%), Europe (18%) and Middle East and Africa (14%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 456754 | 17610 | -11 |

| Venture Financing | 208444 | 17455 | 36 |

| Contract Service Agreement | 1843 | 17001 | 804 |

| Equity Offering | 840078 | 15660 | 149 |

| Licensing Agreement | 670107 | 13237 | 39 |

| Grant | 6529 | 12599 | -35 |

| Acquisition | 3579935 | 10521 | -43 |

| Debt Offering | 1743744 | 7789 | 82 |

| Asset Transaction | 422962 | 6004 | -48 |

| Private Equity | 493744 | 2378 | -32 |

| Merger | 167265 | 656 | 418 |

A breakdown of deals by type and volume shows a 418% growth in mergers year-on-year, while acquisitions are down 44%, partnerships are down -11% and asset transactions are down -48%. Financing deals have increased across some types, with venture financing up 35% YoY, equity offerings up 146% and debt offerings up 82%.

Private equity, however, has seen a drop of -33% in number of deals YoY, while the number of grants recorded is down -35%. The number of contract service agreements recorded by GlobalData is up 804% year-on-year.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of infectious diseases. After remaining relatively steady over the past ten years, the number of recorded deals in infectious diseases increased significantly in 2020 to date, most likely due to the impact of the Covid-19 pandemic on activity in the sector.

Note: All numbers as of 20 October 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

Endo International agrees to acquire BioSpecifics Technologies for $540m

Endo International has agreed to acquire BioSpecifics Technologies in a cash-based transaction valued at approximately $540m. According to the agreement, Endo, via a wholly owned subsidiary, will initiate an all-cash tender offer to acquire all the outstanding common stock of BioSpecifics for $88.50 per share. Under the deal, BioSpecifics will receive a royalty stream from Endo related to the latter’s collagenase-based therapies.

Eli Lilly to acquire biotechnology company Disarm Therapeutics

Eli Lilly has entered a definitive agreement to acquire biotech firm Disarm Therapeutics for an upfront payment of $135m. Under the deal, Disarm’s equity holders may be eligible to receive up to $1.225bn as milestone payments when Eli Lilly develops and commercialises new products resulting from the acquisition. The acquisition will add Disarm’s preclinical SARM1 programmes for axonal degeneration and allow Eli Lilly to expand its R&D efforts in pain and neurodegeneration.

Innovation in neurodegeneration: Libra launches with $29m Series A

San Diego-based Libra Therapeutics has launched after closing a $29m Series A funding round led by BIVF, Epidarex Capital and Santé Ventures. Yonjin Venture, Dolby Family Ventures, and Sixty Degree Capital also contributed to the round. The company plans to use this funding for “the advancement of our pipeline programmes, as well as to build out our team and scientific board”, says Libra CEO Isaac Veinbergs.

Targeting PP2A to tackle cancers: Rappta closes €9m Series A round

Oncology-focused Rappta Therapeutics has raised €9m in a Series A funding round co-led by the Novartis Venture Fund and Novo Holdings through its early-stage investment arm Novo Seeds. UK-based Advent Life Sciences also participated in the round. Rappta CEO Mikko Mannerkoski explains this funding will be used by Rappta to complete the optimisation phase and carry out a proof-of-concept in humans of its first-in-class anti-cancer drugs that activate protein phosphatase 2A.

Targeting the tumour stroma: Phenomic AI launches with $6m seed financing

Toronto-headquartered Phenomic AI has launched with $6m in seed funding. The round was led by CTI Life Sciences Fund, while AV8 Ventures, Luminous Ventures and Viva BioInnovator also joined the round. The company’s two lead programmes were discovered using its artificial intelligence and machine learning platform and they are antibody drugs that target the tumour stroma, which has prevented immunotherapies, such as checkpoint inhibitors, working effectively in solid cancers.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.