Market insight in association witH

Clinical trial disruption due to Covid-19 has begun to slow

Since early March, hundreds of organisations that are acting as the sponsor, collaborator, or contract research organisation (CRO) have publicly announced disruptions to planned and ongoing clinical trials in their press releases, Securities and Exchange Commission (SEC) filings, and clinical trial registries, as well as on social media.

Companies have delayed the initiation of planned trials or withdrawn these completely, as well as suspended enrolment in ongoing trials or terminated these trials. The Covid-19 dashboard on the Pharma Intelligence Center dynamically tracks these disrupted trials and organisations from the Clinical Trials Database, along with trials that have resumed activity since disruption.

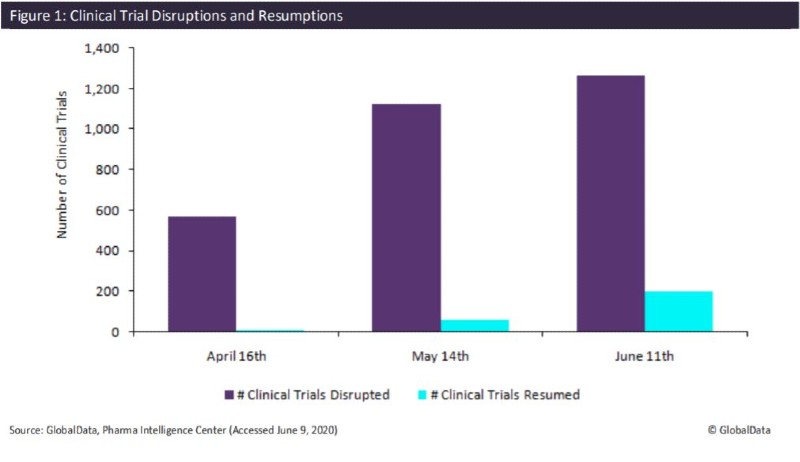

GlobalData found that in the last three months, the number of disrupted clinical trials and organisations has continued to grow, most noticeably between April and May, but this trend has begun to slow (Figure 1). The majority of the disruption, at 61.5%, was due to the suspension of enrolment. Trials currently being impacted due to slow enrolment follows at 22.8%, then finally, 15.7% of trials have delayed initiation.

Within the 22.8% of trials affected by slow enrolment, 12.5% of these are specifically due to the availability of sites and investigators. Many hospitals that serve as trial sites were inundated with Covid-19 patients and are no longer available. For that same reason, many investigators may be repurposed to Covid-19 drug discovery trials or treating Covid-19 patients, or activation of sites for non-Covid-19 trials are being unprioritised. There is also a high risk to subjects in a clinical trial who have a serious chronic or acute condition that affects their immune system, giving them a greater chance of contracting Covid-19.

There are currently 976 organisations that have reported specific disrupted clinical trials in the public domain, 150 more than last month. Of these organisations, over half (574) are private or public companies, with just over 50% located in the US, followed by the UK at 7.3%, France at 4.2%, Sweden at 3.7% (not in the top five last week), and Canada at 3.3%.

The US is currently starting to see the number of new Covid-19 cases and deaths begin to slow, while many European countries experienced high incidence and mortality rates slightly earlier. Eli Lilly now has the highest number of trials that have been specifically reported as disrupted in the public domain by a private or public company, followed by Boehringer Ingelheim, Bristol-Myers Squibb, Shire, and Takeda. The Sarah Cannon Research Institute is the CRO that has reported the highest number of disrupted clinical trials, followed by IQVIA, Covance, Pharmaceutical Product Development, and PRA Health Sciences.

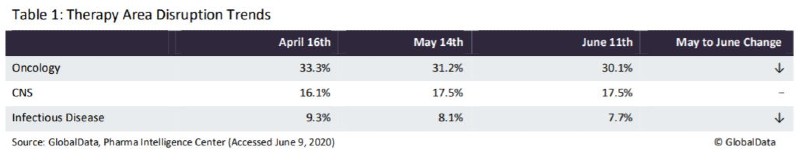

Over all three months, the majority of disrupted clinical trials were in Phase II, from 43%–45%, followed by Phase III with 22%–25%, Phase I with 21%–26%, and Phase IV with 7%–10%. Of these trials, 14% (12.4% May, 12% April) are specifically Pivotal/Registrational, giving an indication that there will be an impact on regulatory approvals in the future. Some of the trends seen in disrupted trials by therapy area over the last three months are shown in Table 1. Oncology and Infectious Disease trials have begun to decrease in overall share since April, while CNS went up from April to May then remained static.

The FDA has issued guidance for industry, investigators, and institutional review boards on conducting clinical trials during the Covid-19 pandemic. Methods that could help keep the research going include virtual visits, phone interviews, self-administration, and remote monitoring. These suggestions could help trials that are being met with subject quarantine and travel limitations, clinical site closures, and interrupted supply chains.

Importantly, there are now over 200 trials that were previously disrupted from the Covid-19 pandemic by delayed initiation and slow or suspended enrolment that are now ongoing or completed. This is 3.2 times more trials that have resumed since a month ago. Therefore, the upward trend for clinical trial delays may begin to slow further as more companies adjust, along with a possible shift toward virtual trials.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.