Feature

Cell and gene therapy approvals drive paradigm change in manufacturing

Trends in gene therapy approvals in recent years are rapidly shaping the future of manufacturing capabilities in the pharmaceutical industry. By Irena Maragkou.

Credit: AuthenticVision / Shutterstock

Innovative cell and gene therapies (CGTs) have significantly disrupted the treatment landscape for several genetic diseases. In recent years, the number of CGT approvals has been on an upward trajectory, with there being ten global approvals announced just last year.

According to a survey completed by GlobalData in November 2023, CGT was scored as the industry trend to have the greatest impact on the pharmaceutical industry in 2024, followed by personalised/precision medicine.

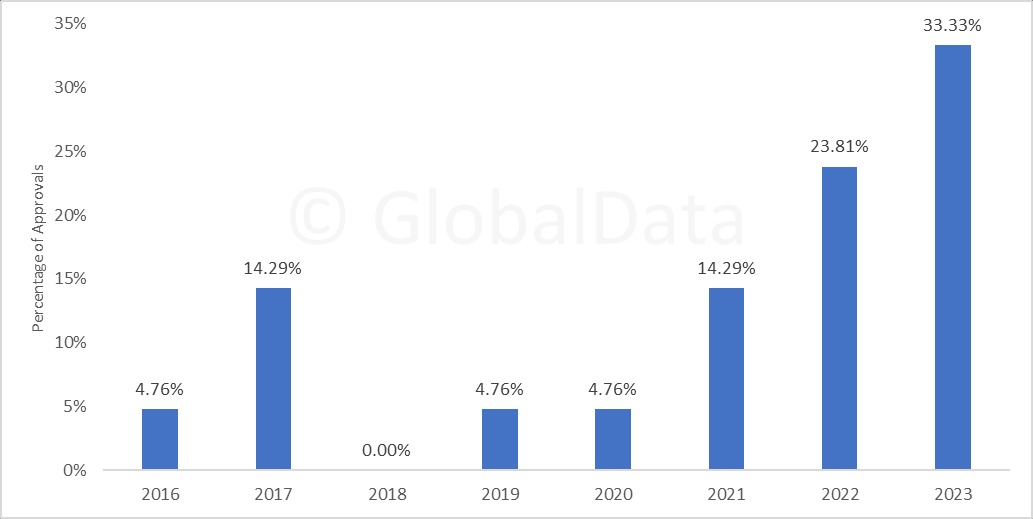

Currently, there are 69 marketed CGTs worldwide, approved by regulatory bodies such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and others. In 2023, a total of seven novel CGTs received FDA approval including notable treatments like Sarepta Therapeutics’ Elevidys (delandistrogene moxeparvovec-rokl), and bluebird bio’s Lyfgenia (lovotibeglogene autotemcel) (Figure 1). The acceleration in approvals in recent years not only highlights the staggering potential of these therapies but also the growing demand for specialized and expanded manufacturing capabilities.

While CGTs are anticipated to become well-established treatment approaches, maintaining rigorous safety and efficacy standards has proven difficult while trying to meet the growing global demand for this therapy class.

Figure 1: CGT approvals in the US in recent years

Source: GlobalData, Pharma Intelligence Center Drugs database (Accessed September 19, 2024) © GlobalData

Note: The chart displays the share of CGT approvals each year among the total number of CGT approvals as per their first approval date. The percentage of CGTs is applicable for marketed drugs only and approval dates are based on publicly available information.

Oncology at the forefront of CGTs

According to GlobalData, the CGT market was valued at $6 billion last year and is projected to grow to $80 billion by 2030 at a compound annual growth rate (CAGR) of 45%. The surge in CGT approvals is largely driven by advancements in technology and genetic engineering tools such as CRISPR gene editing and novel viral vector delivery systems, enabling more precise and personalized therapies that address and target the genetic cause of a condition. Thus, CGTs have emerged as innovative approaches for the treatment of previously “incurable” genetic conditions, offering solutions beyond merely managing symptoms.

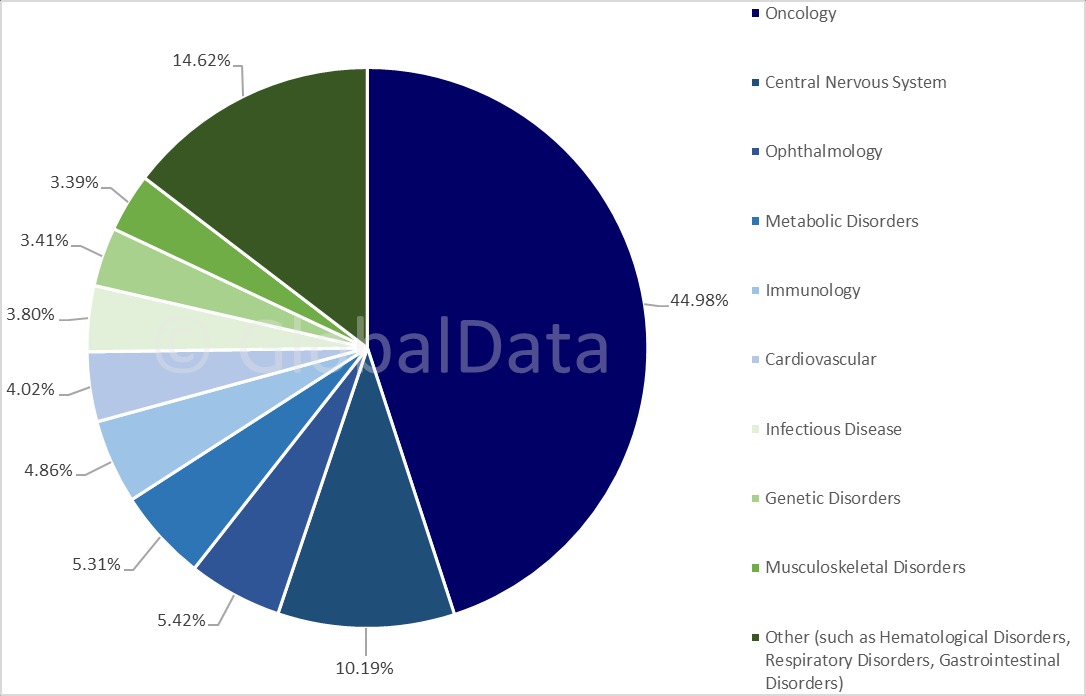

Based on a global analysis of the marketed and investigational CGTs, oncology remains the leading therapeutic area for CGTs, the market for which is set to reach approximately $37bn by 2030, as per GlobalData. Almost 45% of all pipeline and marketed CGTs are developed for oncology indications (Figure 2). However, CGTs may also offer new treatment options for central nervous system disorders, metabolic disorders, immunological conditions, and various rare diseases. The dominance of oncology in the CGT pipeline is expected to persist in the future1.

Figure 2: Marketed and pipeline CGTs according to therapy area

Source: GlobalData, Pharma Intelligence Center Drugs database (Accessed September 18, 2024) ©GlobalData. Note: The chart displays the percentage of pipeline and marketed CGTs by therapy area based on publicly available information.

TILs are anticipated to have the greatest impact among CGTs in the solid tumor space, as per GlobalData. This year, the first tumor-infiltrating lymphocyte (TIL) therapy, Iovance Biotherapeutics’ Amtagvi (lifileucel) gained FDA approval for the treatment of unresectable or metastatic melanoma, a type of solid tumor. CGT sales are expected to be fueled by expanding into earlier treatment lines for conditions like non-Hodgkin lymphoma and multiple myeloma.

While efforts are underway to extend the success of cell therapies in oncology to other therapy areas most of these trials remain in early development stages, with limited suitable targets and ongoing assessment of CGT efficacy and safety. In the gene therapy field, chimeric antigen receptor (CAR)-T cell therapies stand out as a leading treatment, drawing significant investment. Trends in CGT approvals are crucial, as they will strongly influence the manufacturing practices and the future scalability, cost, and accessibility of these regenerative therapies.

Outsourcing vs in-house manufacturing

The number of contract manufacturing agreements for CGTs has been increasing in recent years, in line with increasing approvals and R&D in the CGT space. Up until now, there are more contracts for CGTs in development in comparison to commercial contracts for contract manufacturing organizations (CMOs) (Figure 3). However, this is likely to change as the surge in CGT approvals continues3. Nonetheless, even if there are fewer commercial contracts for approved CGTs, those strategic partnerships are critical due to their high value3.

Figure 3: Contract manufacturing agreements for CGTs per year

Source: GlobalData, Pharma Intelligence Center Deals database (Accessed September 18, 2024) ©GlobalData. Note: The chart displays the number of contract manufacturing agreements for CGTs by year based on publicly available information.

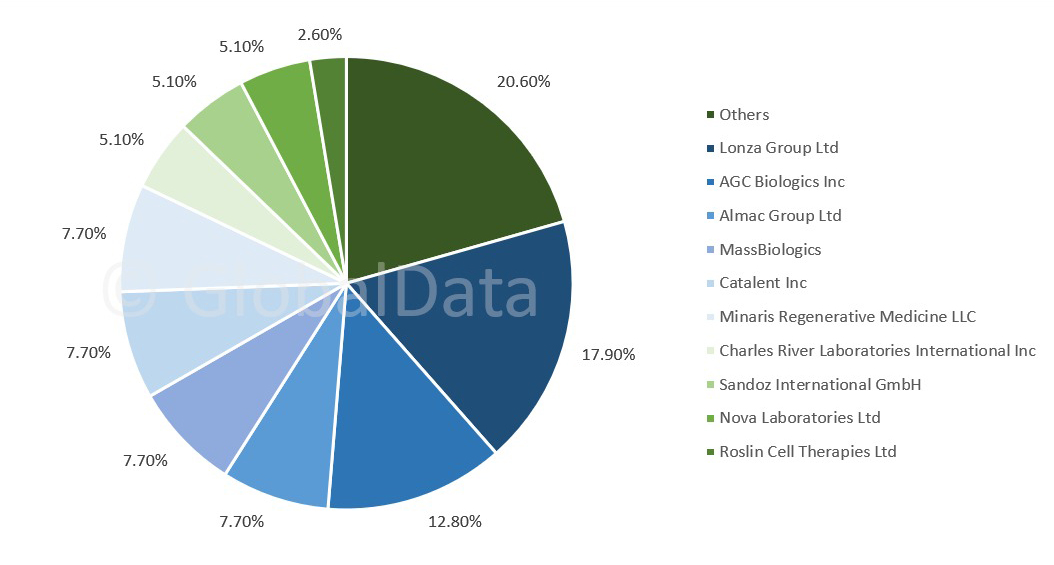

Lonza Group is the leading CMO for contracts of marketed CGTs, owning 17.9% of CMO contracts, based on publicly available information recorded by PharmSource, a GlobalData product (Figure 4). AGC Biologics in the next leading CMO (12.80%), while Almac Group, MassBiologics, Minaris Regenerative Medicine and Catalent all possess about 7.7% of the publicly known CGT manufacturing contracts for marketed CGTs (Figure 4).

Some of Lonza’s notable contracts are with bluebird bio for the manufacturing of Zynteglo (betibeglogene autotemcel) and Skysona (elivaldogene autotemcel), which are indicated for the treatment of beta-thalassemia and active cerebral adrenoleukodystrophy, respectively. Additionally, Lonza has also entered into manufacturing agreements with Iovance Biotherapeutics for Amtagvi. Other CMOs, such as Patheon, by ThermoFisher Scientific, Nova Laboratories, and Wuxi Advanced Therapies also constitute approximately 20.6% of the marketed CGT contracts.

Source: PharmSource, a GlobalData product. (Accessed September 18, 2024) ©GlobalData. Note: This analysis only includes biosimilar and innovator drugs approved in the US, UK, and/or EU, specifically through the EMA’s centralized authorization procedure.

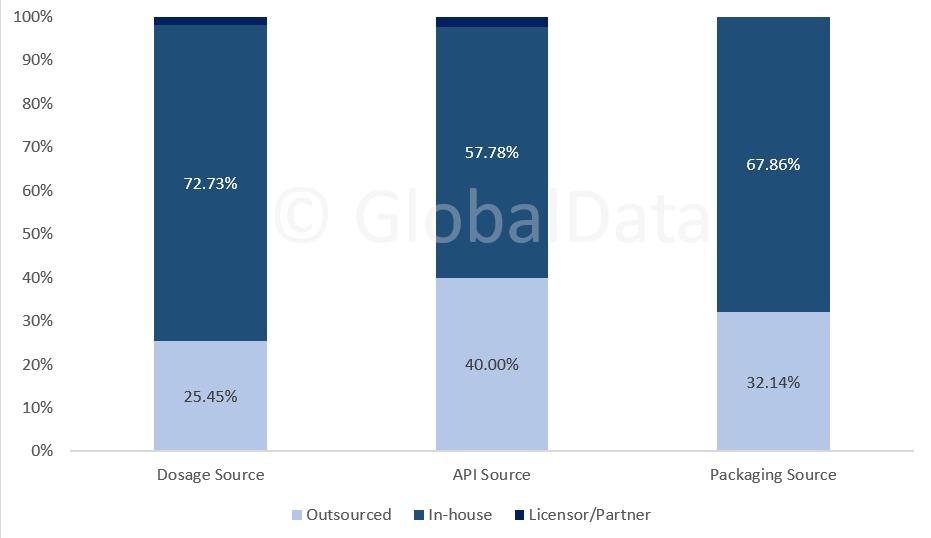

Regarding marketed CGTs in the US, UK and EU, the active pharmaceutical ingredients (APIs) of around 40% of marketed CGTs are outsourced to CDMO facilities (Figure 5). The highest percentage of in-house activities is observed in dosage production, as only 25% of marketed CGT dosages are outsourced to CMO sites (Figure 5). A similar trend is observed in the packaging of marketed CGTs, where approximately 32% of them are outsourced (Figure 5).

Figure 5: Outsourcing vs in-house manufacturing of marketed CGTs

Source: PharmSource, a GlobalData product. (Accessed September 18, 2024) ©GlobalData. Note: This analysis only includes biosimilar and innovator drugs approved in the US, UK, and/or EU, specifically through the EMA’s centralized authorization procedure.

A key point to consider is that dual or multiple sourcing takes place in the CGT sector. Due to complexity, some parts of production are completed in one facility and then shipped out to other facilities. As supply chains can be fragile, redundancies are built into supply chains on purpose. In general, smaller companies—those with a market cap lower than $2bn, tend to outsource their manufacturing as they lack the required facilities and in-house capabilities.

This is an excerpt of an article published in the CPHI 2024 report released at the CPHI conference, which took place 8-10 October in Milan, Italy.