Five pipeline agents, including new mechanisms of action, vying for share in the crowded RA market

GlobalData projects that between 2019 and 2029, seven major markets (7MM: US, France, Germany, Italy, Spain, UK, and Japan) will see the approval and launch of five new agents for the treatment of rheumatoid arthritis (RA). Agents include one GM-CSF-inhibiting biologic (GSK’s otilimab), one IL-6-inhibiting biologic (R-Pharm’s olokizumab), one TNF-inhibiting biologic (Taisho’s ozoralizumab), one BTK inhibitor (Roche/Genentech’s fenebrutinib), and one IRAK 4 inhibitor (Pfizer’s PF-06650833).

Ozoralizumab is an inhibitory anti-TNF-α trivalent nanobody complex. Two nano-bodies target TNF-α while one binds to human serum albumin, theoretically extending the drug’s half-life and distribution in vivo. The drug is formulated for administration via subcutaneous (SC) injection every four weeks. Ozoralizumab was originally developed by Ablynx, which was acquired by Sanofi in early 2018.

Very limited efficacy and safety data are currently available for ozoralizumab, and thus, the drug’s prospects as a sixth-to-market TNF inhibitor in Japan remain uncertain. Olokizumab is a humanised interleukin-6 (IL-6) monoclonal antibody (mAb) that acts by blocking the final assembly of IL-6 to its signalling complex.

Phase IIb clinical development targeted patients who had unsuccessful responses to anti-TNF therapy. In H2 2020, R-Pharm announced positive topline results from CREDO 2 and CREDO 3, stating that all primary and secondary endpoints were achieved and that both once per month and twice per month dosing regimens were superior to placebo and non-inferior to adalimumab.

There are currently two other IL-6 inhibitors, Roche/Genentech/Chugai’s Actemra/RoActemra (tocilizumab) and Sanofi/Regeneron/Asahi Kasei’s Kevzara (sarilumab). Otilimab is a fully human monoclonal antibody (IgG1) directed against granulocyte-macrophage colony-stimulating factor (GM-CSF) that is in Phase III development by GSK.

GM-CSF is a cytokine that drives the activation and proliferation of multiple innate immune cell types and is implicated in a wide range of auto-immune diseases. KOLs were relatively enthusiastic about otilimab, particularly in the context of it being a novel MOA that could provide another option to patients who are TNF inhibitor refractory.

Finally, there are two kinase inhibitors, fenebrutinib, a small-molecule inhibitor of Bruton’s tyrosine kinase (BTK) in development by Roche/Genentech, and PF-06650833, a highly selective, reversible, small-molecule inhibitor of interleukin-1 receptor-associated kinase 4 (IRAK4) in development by Pfizer.

Both of these agents would be small-molecule, oral therapies, which are in high need for rheumatoid arthritis due to the significant costs associated with biologics, currently dominate the market. KOLs were intrigued by these new mechanisms of action (MOAs) but believed the drugs would be most effective as part of combination therapy with TNF or JAK inhibitors.

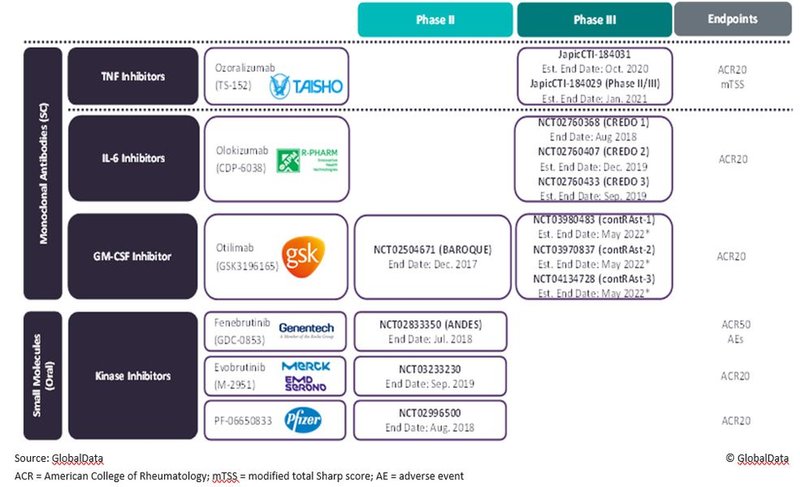

Figure 1 outlines the key Phase III/Phase IIb trials for these promising late-stage pipeline agents.

Figure 1: Key Phase II/III Trials for the Promising Pipeline Agents that GlobalData Expects to Be Licensed for RA in the 8MM During the Forecast Period, 2019–2029

For pharmaceutical industry data, comment and analysis, visit GlobalData's Pharmaceuticals Intelligence Centre.

Market Insight from