DEALS ANALYSIS

Deals activity: Asia-Pacific deals on the up; acquisitions decline

Powered by

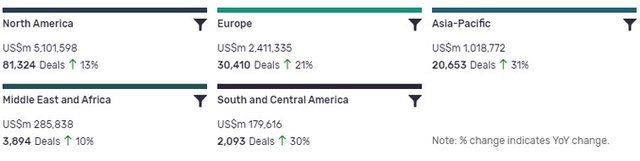

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded the second lowest YoY growth in deals volume at 13%. Asia-Pacific, ranking third in terms of deal value, has seen the biggest YoY change, with deal volumes increasing by 31%.

The volume of deals recorded by GlobalData also increased YoY in South and Central America (30%), Europe (21%) and Middle East and Africa (10%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 461,925 | 17,802 | 4 |

| Venture Financing | 216,454 | 17,700 | 55 |

| Contract Service Agreement | 1,849 | 17,520 | 665 |

| Equity Offering | 869,158 | 15,933 | 160 |

| Licensing Agreement | 690,070 | 13,384 | 66 |

| Grant | 6,672 | 12,791 | -8 |

| Acquisition | 3,648,255 | 10,606 | -40 |

| Debt Offering | 1,757,094 | 7,823 | 24 |

| Asset Transaction | 425,080 | 6,020 | -51 |

| Private Equity | 497,122 | 2,441 | -6 |

| Merger | 167,235 | 661 | 283 |

A breakdown of deals by type and volume shows a 283% growth in mergers YoY, while acquisitions are down 40%, partnerships grew with 4% change YoY and asset transactions are down -51%. Financing deals have increased across some types, with venture financing up 55% YoY, equity offerings up 160% and debt offerings up 24%.

Private equity, however, has seen a drop of -6% in number of deals YoY, while the number of grants recorded is down -8%. The number of contract service agreements recorded by GlobalData is up 665% YoY.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of infectious diseases. After remaining relatively steady over the past ten years, the number of recorded deals in infectious diseases increased significantly in 2020 to date, most likely due to the impact of the Covid-19 pandemic on activity in the sector.

Note: All numbers as of 15 December 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

AstraZeneca to acquire biopharmaceutical firm Alexion for $39bn

AstraZeneca has signed a definitive agreement to acquire global biopharmaceutical company Alexion Pharmaceuticals for $39bn or $175 a share. According to the agreement, Alexion shareholders will receive $60 in cash and 2.1243 AstraZeneca American Depositary Shares for each Alexion share.

Boehringer to acquire NBE-Therapeutics for $1.43bn

Boehringer Ingelheim has signed a binding agreement to acquire all shares of clinical-stage Swiss biotechnology company NBE-Therapeutics for a total of €1.18bn ($1.43bn) to enhance its cancer pipeline portfolio. The deal also includes contingent clinical and regulatory milestones.

Gilead Sciences to acquire German biotech firm MYR for $1.4bn

Gilead Sciences has signed a definitive agreement to acquire German biotechnology company MYR for approximately €1.15bn ($1.4bn) in cash. According to the deal, MYR is also eligible for a potential future milestone payment of up to €300mn ($363m), upon closing of the deal. With this deal, Gilead will acquire first-in-class entry inhibitor Hepcludex (bulevirtide) for the treatment of chronic hepatitis delta virus, a severe form of viral hepatitis.

Arcus Biosciences and WuXi Biologics expand deal for antibodies development

Biopharmaceutical company Arcus Biosciences has expanded its existing strategic relationship with Chinese company WuXi Biologics to discover anti-CD39 antibodies using the latter’s proprietary technology. According to the agreement, Arcus will gain exclusive worldwide rights to anti-CD39 antibodies discovered under the partnership and handle all their further development and commercialisation activities.

Boehringer to acquire German biotech firm Labor Dr Merk & Kollegen

Boehringer Ingelheim has signed an agreement to acquire all the shares of Germany-based biotech company Labor Dr Merk & Kollegen to strengthen its cancer immunology programme. This deal will enable Boehringer to further develop ATMP-based immuno-oncology therapies such as the Vesicular Stomatitis Virus with modified glycoprotein platform and cancer vaccines platforms.

KU Leuven, Batavia partner to develop Covid-19 vaccine candidate

KU Leuven in Belgium has partnered with contract development and manufacturing organisation, Batavia Biosciences, to develop a vector-based Covid-19 vaccine candidate. The KU Leuven Rega Institute for Medical Research Virology research team, headed by Prof Dr Johan Neyts, developed a vaccine candidate with an attenuated vector carrying the SARS-CoV-2 spike immunogen.