R&D

Trial termination analysis unveils a silver lining for patient recruitment

Urtė Fultinavičiūtė tracks the rollout of the EU’s new Clinical Trials Information System and the progress on other key initiatives.

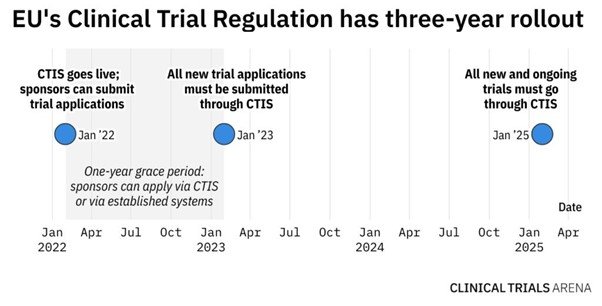

With around two months to go until all new clinical trial applications (CTAs) have to be submitted via the EU’s Clinical Trials Information System (CTIS), sponsors are still playing the waiting game. CTIS and Clinical Trials Regulation (CTR) went live earlier this year with the aim to improve the regulatory and ethics assessments for clinical trials in Europe.

CTIS and CTR are part of the key priorities outlined in Accelerating Clinical Trials in the EU (ACT EU). ACT EU is an initiative to transform the initiation, design, and conduct of clinical trials. It was launched in January by the European Commission (EC), the Heads of Medicines Agencies (HMA), and the EMA. The aim of ACT EU is “to better integrate clinical research in the European health system”, with a focus on the successful implementation of CTR and CTIS. While the EMA was planning to complete this initiative in two years, the agency released an extended timeline of the workplan in August.

Experts discuss with this news service if EMA’s plans to further improve clinical trial conduct in Europe over the next four years are realistic, and why sponsors are still using the old directive, even if the deadlines are fast approaching.

ACT EU workplan extension

The original ACT EU strategy outlined 10 priority list actions for 2022–23. One of the key priorities tackled the wealth of data generated from clinical trials by creating an analytics dashboard. Another priority action aimed to clarify innovative clinical trial designs and publish key methodologies on decentralised clinical trials (DCTs) and artificial intelligence. Some of the priority actions have been achieved, such as monthly Key Performance Indicator (KPI) reports and clinical trials newsletters. However, the majority of the priorities outlined in ACT EU are still in the making, says Verena Koepke, senior vice president of clinical operations in Europe at Alira.

In August, the agency announced its revamped ACT EU workplan, which spans from 2022 until 2026, and outlines in detail what will happen over the next four years. The extension of the initiative and launch of the workplan might have been expected, as it became obvious how large a scope it was to tackle all of the 10 priorities in just two years, says Aman Khera, vice president, global head of regulatory strategy at Worldwide Clinical Trials. The workplan makes these objectives more transparent, as all of the priorities and deliverables are described in detail, she adds.

EMA’s plans in 2023

In 2023, the EMA is planning to focus on large and multinational clinical trials (especially academia-led studies), the continued implementation of CTR and CTIS, a multi-stakeholder platform, the modernisation of good clinical practice, and the facilitation of innovative clinical trial methods with a special focus on DCTs. Guidance and a methodology roadmap are expected to be published by the end of 2022.

Koepke says that while it makes sense why the EMA wants to see a balance between commercial- and academic-driven multinational trials, this priority is slightly too ambitious. She explains that academic sites do not have the resources to manage such big studies, and if the agency wants to see a change, it needs to provide better funding.

The EMA’s latest KPI report, which was published at the end of October, shows that only five non-commercial multinational trials received a decision compared to 22 commercial trials. “This is something we will have to continue to monitor, and maybe in six months time we will be seeing something different,” Khera says.

In terms of other 2023 priorities, Khera says that the industry needs to get started and the workplan for next year is not too ambitious. “This is the right level of speed that we need because there is a lot of change,” she adds.

CTIS uptake still dragging

Some of these minor setbacks were expected, and setting out ambitious, Europe-wide standards was obviously going to be complex, says Hugo Cervantes, vice president of Vault Clinical at Veeva Systems, adding that this also reflects on the uptake of CTIS so far. In July, Clinical Trials Arena reported that sponsors were still using EudraCT more than CTIS.

While the slow uptake of CTIS was expected earlier this year and experts were urging sponsors to step up, Cervantes reiterates that companies need to start using the new portal now, especially the ones that have not tried it yet. “This is the time to be defining the new operating model process,” he says.

Phlexglobal, a technology and services organisation for clinical and regulatory matters, shared with this news service some preliminary data from an ongoing survey analysing the sponsors’ experience using CTIS. The topline results reveal that a third of the respondents have not yet identified roles or responsibilities for CTIS engagement.

Also, 46% of the respondents expect regulatory operations teams to be primarily responsible for engaging with CTIS, compared to 31% who think that clinical operations teams should control the CTAs submissions.

According to the latest EMA KPI report, the use of CTIS has been growing since its launch at the end of January, reaching peak submissions in August with 81 CTAs. However, a high number of CTAs are still being submitted via EudraCT.

What is holding sponsors back?

Some sponsors are still hoping to complete their studies before EudraCT closes its doors in 2025. “Even though we are really advocating for CTIS, we sometimes hear sponsors say that if they are really quick to recruit patients, the trial will end in 2024,” Koepke says. Khera agrees that sponsors should be cautious if such an approach is taken, adding that while this might have been the case a few months ago, the “door of luxury is closing”.

Some companies are still hesitant to submit applications via CTIS due to a lack of awareness and understanding of the portal. “From a CRO perspective, we get a lot of experience from working with different sponsor companies and different applications, but the lens of a CRO can be quite different to a sponsor that may have one or two products under development,” Khera says.

Preparation for submissions is another factor contributing to the slow uptake, as sponsors need to plan their applications well ahead of time. Previously, sponsors could apply for a study in one country and deal with other countries later, which is not possible with CTIS, Khera explains. Stricter timelines to have the first patient in or to start a clinical trial at a particular time create an additional layer of pressure on sponsors, she adds.

The latest KPI report shows that the commercial sector is leading the overall applications via CTIS. In July, non-commercial sponsors had the most authorised CTAs, but the recent report shows that the commercial sponsors are catching up.

Data collection and management still challenging

When CTIS was launched, it was known that there would be a big need for change management regarding data collection and management. Cervantes says that while a handful of larger organisations have already built internal solutions and organisationally defined who will be collecting the information and documents needed for submissions, other sponsors are still working to understand the exact data requirements and the process around Part I and Part II submissions. The new application process has two parts: Part I contains documents that feature scientific and medical product documents, while Part II has national and patient-level documents.

With CTIS and CTR came increased transparency, and more data is being made available to the public. This means that sponsors need to think about some of the risks around protecting personal data and commercially sensible information, Cervantes says. “Human oversight is needed to be constantly on top of that and making sure that the right documents have been redacted and [that] they are up to date,” he explains.

Another challenge is that CTIS does not have direct integration capabilities, meaning that data and information have to be manually entered into the system, which is a high effort burden, Cervantes notes. Phlexglobal's survey shows so far that 42% of the respondents will keep track of CTIS activity ‘manually’, for example using Excel. Cervantes says that with time, the EMA might introduce an application programming interface (API) to connect with or an ability to better automate the process.

However, Khera says that while the EMA is probably thinking about how to make CTIS better, automation is still far away. “You can only automate something when you understand what needs to be automated,” she says.

“CTIS has more advantages than disadvantages, and it is just a matter of time and experience,” Koepke says. Khera encourages sponsors to seek out help, whether through stakeholders that understand CTIS or the library of resources that EMA has provided. “We need to give this new system a chance, and it can always be refined with industry giving that feedback,” she adds.

From the end of January 2023, sponsors will have to use CTIS to submit all new clinical trials applications. In January 2025, EudraCT will close its doors, meaning that all new and ongoing studies will need to be transferred to CTIS. While this is a big management change, the long-term benefits of working with regulatory bodies and having better clarity over submission and approval timelines will outweigh the short-term operating inefficiencies.

Main image credit: